Electric Vehicle Credit Irs 2021 . tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for eligible used electric vehicles. You can claim the credit yourself or. form 8936 is an irs form taxpayers can use to claim a tax credit for an electric vehicle as long as they meet certain eligibility requirements. treasury and the internal revenue service released guidance and faqs with information on how the north america. find out if your electric vehicle (ev) or fuel cell vehicle (fcv) qualifies for a tax credit based on type, purchase date and business or. consumers that purchase a qualifying electric vehicle can continue to claim the electric vehicle tax credit on their annual tax filing.

from insideevs.com

tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for eligible used electric vehicles. treasury and the internal revenue service released guidance and faqs with information on how the north america. find out if your electric vehicle (ev) or fuel cell vehicle (fcv) qualifies for a tax credit based on type, purchase date and business or. You can claim the credit yourself or. form 8936 is an irs form taxpayers can use to claim a tax credit for an electric vehicle as long as they meet certain eligibility requirements. consumers that purchase a qualifying electric vehicle can continue to claim the electric vehicle tax credit on their annual tax filing.

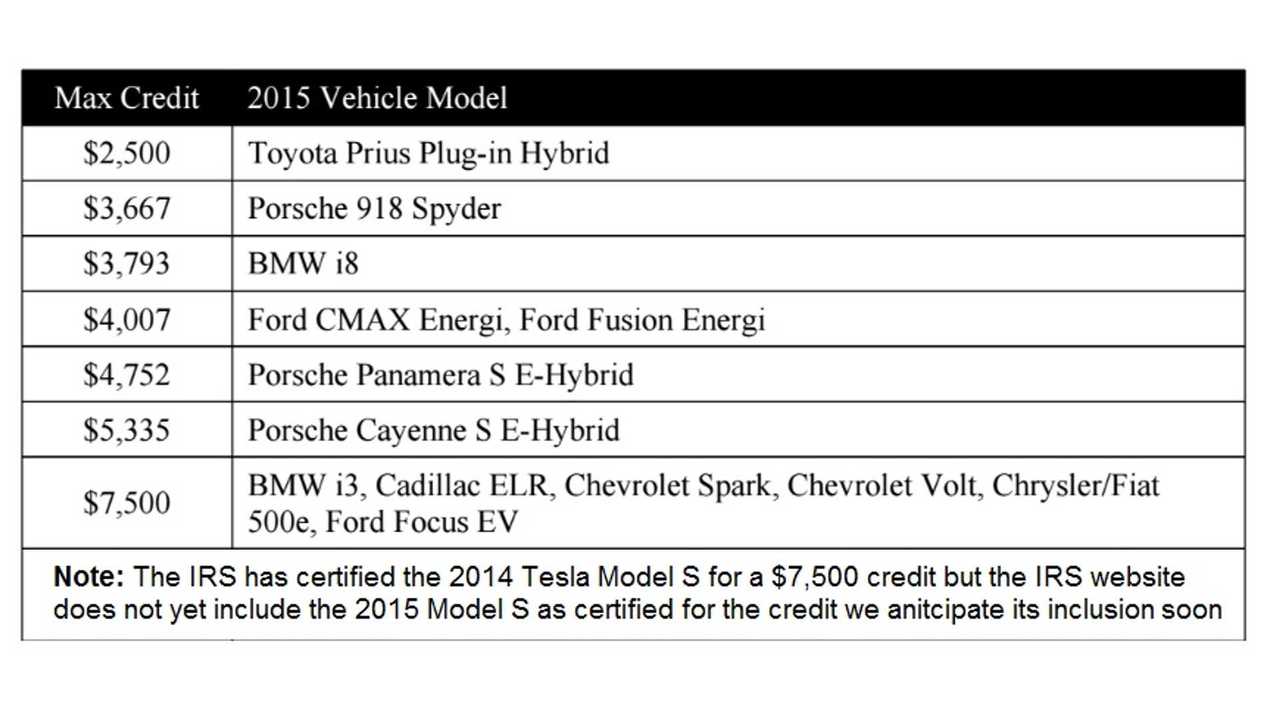

Accelerating The Plugin Electric Vehicle Tax Credit In The US

Electric Vehicle Credit Irs 2021 treasury and the internal revenue service released guidance and faqs with information on how the north america. form 8936 is an irs form taxpayers can use to claim a tax credit for an electric vehicle as long as they meet certain eligibility requirements. consumers that purchase a qualifying electric vehicle can continue to claim the electric vehicle tax credit on their annual tax filing. You can claim the credit yourself or. treasury and the internal revenue service released guidance and faqs with information on how the north america. find out if your electric vehicle (ev) or fuel cell vehicle (fcv) qualifies for a tax credit based on type, purchase date and business or. tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for eligible used electric vehicles.

From www.templateroller.com

Download Instructions for IRS Form 8936 Qualified PlugIn Electric Electric Vehicle Credit Irs 2021 find out if your electric vehicle (ev) or fuel cell vehicle (fcv) qualifies for a tax credit based on type, purchase date and business or. treasury and the internal revenue service released guidance and faqs with information on how the north america. form 8936 is an irs form taxpayers can use to claim a tax credit for. Electric Vehicle Credit Irs 2021.

From patrick-wilson5959.blogspot.com

2021 electric car tax credit irs Ngoc Schafer Electric Vehicle Credit Irs 2021 You can claim the credit yourself or. tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for eligible used electric vehicles. consumers that purchase a qualifying electric vehicle can continue to claim the electric vehicle tax credit on their annual tax filing. find out if your electric vehicle (ev) or. Electric Vehicle Credit Irs 2021.

From www.templateroller.com

IRS Form 8834 Download Fillable PDF or Fill Online Qualified Electric Electric Vehicle Credit Irs 2021 tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for eligible used electric vehicles. form 8936 is an irs form taxpayers can use to claim a tax credit for an electric vehicle as long as they meet certain eligibility requirements. treasury and the internal revenue service released guidance and faqs. Electric Vehicle Credit Irs 2021.

From evadoption.com

How The Federal Electric Vehicle (EV) Tax Credit Works EVAdoption Electric Vehicle Credit Irs 2021 treasury and the internal revenue service released guidance and faqs with information on how the north america. form 8936 is an irs form taxpayers can use to claim a tax credit for an electric vehicle as long as they meet certain eligibility requirements. consumers that purchase a qualifying electric vehicle can continue to claim the electric vehicle. Electric Vehicle Credit Irs 2021.

From thinkev-usa.com

Electric Vehicle Tax Credits A Comprehensive Guide ThinkEVUSA Electric Vehicle Credit Irs 2021 tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for eligible used electric vehicles. form 8936 is an irs form taxpayers can use to claim a tax credit for an electric vehicle as long as they meet certain eligibility requirements. consumers that purchase a qualifying electric vehicle can continue to. Electric Vehicle Credit Irs 2021.

From www.teachmepersonalfinance.com

IRS Form 8834 Instructions Qualified Electric Vehicle Credit Electric Vehicle Credit Irs 2021 You can claim the credit yourself or. form 8936 is an irs form taxpayers can use to claim a tax credit for an electric vehicle as long as they meet certain eligibility requirements. tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for eligible used electric vehicles. find out if. Electric Vehicle Credit Irs 2021.

From www.templateroller.com

Download Instructions for IRS Form 8936 Qualified PlugIn Electric Electric Vehicle Credit Irs 2021 form 8936 is an irs form taxpayers can use to claim a tax credit for an electric vehicle as long as they meet certain eligibility requirements. treasury and the internal revenue service released guidance and faqs with information on how the north america. consumers that purchase a qualifying electric vehicle can continue to claim the electric vehicle. Electric Vehicle Credit Irs 2021.

From www.sterling.cpa

Tax Credit for Electric Vehicle The Latest from the IRS Electric Vehicle Credit Irs 2021 find out if your electric vehicle (ev) or fuel cell vehicle (fcv) qualifies for a tax credit based on type, purchase date and business or. form 8936 is an irs form taxpayers can use to claim a tax credit for an electric vehicle as long as they meet certain eligibility requirements. tax credits up to $7,500 are. Electric Vehicle Credit Irs 2021.

From fixengineeisenpark8i.z4.web.core.windows.net

Hybrid Cars Eligible For Tax Credit Electric Vehicle Credit Irs 2021 form 8936 is an irs form taxpayers can use to claim a tax credit for an electric vehicle as long as they meet certain eligibility requirements. find out if your electric vehicle (ev) or fuel cell vehicle (fcv) qualifies for a tax credit based on type, purchase date and business or. consumers that purchase a qualifying electric. Electric Vehicle Credit Irs 2021.

From evadoption.com

Proposed Changes to the Federal EV Tax Credit Passed by the House of Electric Vehicle Credit Irs 2021 tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for eligible used electric vehicles. form 8936 is an irs form taxpayers can use to claim a tax credit for an electric vehicle as long as they meet certain eligibility requirements. find out if your electric vehicle (ev) or fuel cell. Electric Vehicle Credit Irs 2021.

From dpwcpas.com

Electric Vehicle Tax Credits What You Need to Know Doty Pruett and Electric Vehicle Credit Irs 2021 form 8936 is an irs form taxpayers can use to claim a tax credit for an electric vehicle as long as they meet certain eligibility requirements. tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for eligible used electric vehicles. You can claim the credit yourself or. consumers that purchase. Electric Vehicle Credit Irs 2021.

From www.templateroller.com

IRS Form 8936 Download Fillable PDF or Fill Online Qualified PlugIn Electric Vehicle Credit Irs 2021 find out if your electric vehicle (ev) or fuel cell vehicle (fcv) qualifies for a tax credit based on type, purchase date and business or. form 8936 is an irs form taxpayers can use to claim a tax credit for an electric vehicle as long as they meet certain eligibility requirements. You can claim the credit yourself or.. Electric Vehicle Credit Irs 2021.

From edu.svet.gob.gt

How Do The Used And Commercial Clean Vehicle Tax Credits Electric Vehicle Credit Irs 2021 consumers that purchase a qualifying electric vehicle can continue to claim the electric vehicle tax credit on their annual tax filing. treasury and the internal revenue service released guidance and faqs with information on how the north america. find out if your electric vehicle (ev) or fuel cell vehicle (fcv) qualifies for a tax credit based on. Electric Vehicle Credit Irs 2021.

From dxouvddgo.blob.core.windows.net

How Does Electric Car Tax Work at Peter Gruber blog Electric Vehicle Credit Irs 2021 tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for eligible used electric vehicles. find out if your electric vehicle (ev) or fuel cell vehicle (fcv) qualifies for a tax credit based on type, purchase date and business or. treasury and the internal revenue service released guidance and faqs with. Electric Vehicle Credit Irs 2021.

From www.templateroller.com

Download Instructions for IRS Form 8936 Qualified PlugIn Electric Electric Vehicle Credit Irs 2021 tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for eligible used electric vehicles. treasury and the internal revenue service released guidance and faqs with information on how the north america. consumers that purchase a qualifying electric vehicle can continue to claim the electric vehicle tax credit on their annual. Electric Vehicle Credit Irs 2021.

From medium.com

Federal Tax Credits for Electric Vehicle Buyers Now Available at Electric Vehicle Credit Irs 2021 consumers that purchase a qualifying electric vehicle can continue to claim the electric vehicle tax credit on their annual tax filing. You can claim the credit yourself or. treasury and the internal revenue service released guidance and faqs with information on how the north america. tax credits up to $7,500 are available for eligible new electric vehicles. Electric Vehicle Credit Irs 2021.

From evadoption.com

Impact of Proposed Changes to the Federal EV Tax Credit Part 1 Electric Vehicle Credit Irs 2021 You can claim the credit yourself or. find out if your electric vehicle (ev) or fuel cell vehicle (fcv) qualifies for a tax credit based on type, purchase date and business or. form 8936 is an irs form taxpayers can use to claim a tax credit for an electric vehicle as long as they meet certain eligibility requirements.. Electric Vehicle Credit Irs 2021.

From www.youtube.com

Electric Vehicle Tax Credits on IRS Form 8936 YouTube Electric Vehicle Credit Irs 2021 consumers that purchase a qualifying electric vehicle can continue to claim the electric vehicle tax credit on their annual tax filing. You can claim the credit yourself or. find out if your electric vehicle (ev) or fuel cell vehicle (fcv) qualifies for a tax credit based on type, purchase date and business or. tax credits up to. Electric Vehicle Credit Irs 2021.